MAYOR BLOOMBERG & CONSUMER AFFAIRS COMMISSIONER MINTZ ANNOUNCE NEW DEBT COLLECTION REGULATIONS TO PROTECT NEW YORKERS FROM BEING HARASSED FOR DEBTS THEY DO NOT OWE

Wrongful Debt Collection Attempts Tops Consumer Affairs’ List of Complaints

Photo Credit: Edward Reed

Mayor Michael R. Bloomberg and Department of Consumer Affairs Commissioner Jonathan Mintz announced new debt collection regulations designed to prevent New Yorkers from being harassed about debts they don’t owe – a problem that has grown since the onset of the national recession in late 2007.

Collectors, armed with a list of debtors, routinely attempt to collect from anyone in the five boroughs with the same name as a person on the list regardless of whether the debt belongs to that person. Under the new regulations, any debt collection agency attempting to collect a debt from a New Yorker must provide proof the debt is owed at the consumer’s request. The collector must provide:

Other provisions of the new regulations include disclosing the consumer’s rights regarding the statute of limitations, and providing written confirmation of the debt payment schedule or settlement within 21 days of the agreement. In addition, debt collection agencies must provide New Yorkers with a phone number that must be answered by a live operator and not an answering service.

“New Yorkers have long had strong protections when it comes to debt collection, in fact, the strongest local protections in the country,” said Mayor Bloomberg. “As the national recession worsened, exploitative debt collection schemes have become more brazen. Collectors get lists online and harass everyone with the same name on the list putting every person they call on the defensive. The measures we are announcing today will help stop this rising tide of wrongful and financially harmful collection tactics, and protect New Yorkers from their often damaging consequences.”

“Wrongful debt collection is more than just annoying and stressful,” said Consumer Affairs Commissioner Jonathan Mintz. “Such wrongful collection attempts can cause serious and long term damage to a family’s finances including seized bank accounts, damaged credit ratings, and more. Consumers receiving improper debt collection calls should contact us by calling 311 or filing a complaint online.”

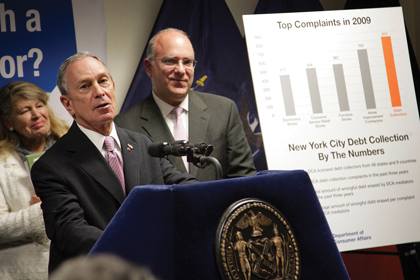

During 2009, the City’s Department of Consumer Affairs erased more than $1 million in debt that New Yorkers didn’t legally owe but were pressed to pay anyway. Wrongful debt collection topped the list of complaints at DCA for the second year in a row and last year the City received more than 830 complaints against debt collectors.

Any business collecting debts from New York City residents must be licensed by DCA and must follow strict guidelines set by New York City Law. Currently, there are approximately 1,700 licensed debt collectors from all over the country attempting to collect debts from New York City residents. Consumer complaints regarding debt collectors generally concern debts consumers do not owe or alleged harassment tactics by the debt collector such as contacting an employer or calling in the middle of the night.

As part of the Bloomberg Administration’s anti-poverty efforts, DCA’s Office of Financial Empowerment, the first program implemented under the Center for Economic Opportunity, offers free, professional financial counseling and assistance with debt at 20 Financial Empowerment Centers Citywide. City residents can call 311 or visit www.nyc.gov to find financial education classes, counseling and workshops nearest them. The City’s Financial Education Network Directory also provides a list of free and low cost classes, workshops, and counseling services to make managing your money easier than ever.

DCA enforces the Consumer Protection Law and other related business laws throughout New York City. Ensuring a fair and vibrant marketplace for consumers and businesses, DCA licenses more than 71,000 businesses in 57 different industries. Through targeted outreach, partnerships with community and trade organizations, and informational materials, DCA educates consumers and businesses alike about their rights and responsibilities. DCA’s Office of Financial Empowerment is the first municipal office of its kind in the nation with a mission to educate, empower and protect New Yorkers with low incomes. The Office of Financial Empowerment administers a citywide network of Financial Empowerment Centers and other products and services that help these New Yorkers make the best use of their financial resources to move forward economically. For more information, call 311 or visit DCA online atnyc.gov.

Photo Credit: Edward Reed

TOP 10 THINGS TO KNOW ABOUT DEBT COLLECTION IN NEW YORK CITY

WHAT TO DO IF A DEBT COLLECTION AGENCY CONTACTS YOU

1. the name of the debt collection agency,

2. the name of the original creditor,

3. the amount of the debt,

4. a call back number to a phone that is answered by a live person, and

5. the name of that person.

If your call is routed from the agency’s main telephone line the live person qualified to handle your questions must answer the call within 60 seconds.

Photo Credit: Edward Reed