YOUNG DRIVERS INSURANCE AND SAFETY UPDATE

BY ALAN PLAFKER, PRESIDENT & CEO

MEMBER BROKERAGE SERVICE LLC

A MELROSE CREDIT UNION SERVICE ORGANIZATION

Your young drivers—help them play it safe

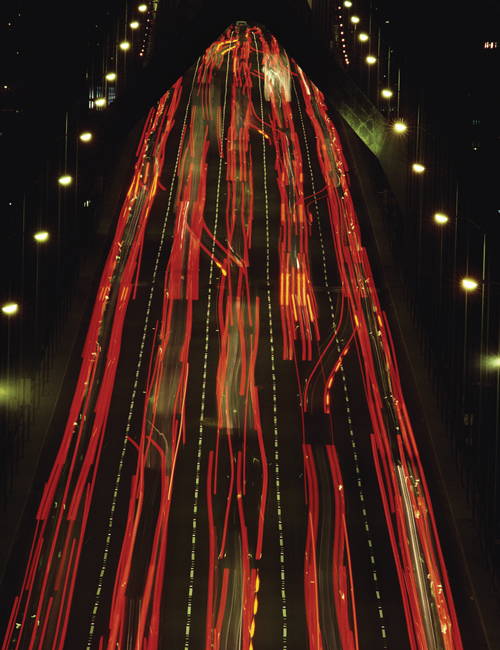

The Insurance Institute for Highway Safety reports that 74 percent of 16 year olds' crashes are caused by driver error. Young licensed drivers, ages 15 to 24, account for the highest fatality rates. Alarmed by the high number of serious accidents involving teen drivers our agency urges you to help your teen driver slow the transition to the road and give him or her more time to learn and mature.

What can I do as a parent of a teen getting ready to hit the road?

As a concerned parent there is much you can do to help make your teen a safer driver. Set time aside to help your teen prepare and practice, and set limits for your young driver.

Encourage awareness of traffic safety.

Set and enforce important rules.

Is there a way to lower the auto insurance rates for my young driver?

Automobile rates tend to be higher for drivers under age 25 because as a group they are involved in more crashes than people of other ages. As your professional insurance agent it is our job to see that you get the best coverage at the best price.

Check with your agency to see if your auto insurance company offers any of the following discounts:

Remember, you also may elect to take on a higher deductible for collision coverage which will lower the premium. Or, if you have an older car, you may wish to drop the collision coverage.

Be sure to contact your agency when you are ready to add your teen driver to your auto policy.

CAR + TEENAGER = (EXPENSIVE) TROUBLE

Statistically speaking.

Driving is one of society's more dangerous activities no matter who is behind the wheel, But, according to an Autos.com interpretation of Census data, "[f]or every mile driven, teens between the ages of 16 and 19 are four times as likely to be involved in a car crash." It's no wonder that car insurance premiums are so high for this age group. But parents can take comfort in knowing that there are some steps you can take to lower your son's or daughter's risk and his or her insurance premiums.

If you're just trying to find the lowest rate you can, try these:

Regardless of which strategies you pursue to reduce risk and control costs give us a call as you put your teen on the road. Your Agent can help you sort through your options (and find others!) to get your son or daughter driving safely at a price you can afford.

VIOLATING NEW YORK'S CELL PHONE LAW NOW PUTS POINTS ON YOUR LICENSE

Since New York's cell phone ban was signed into law in 2001 more than 300,000 tickets have been issued each year for using a cell phone while driving. In February this year, the New York State Department of Motor Vehicles began imposing two points for the violation of using a cell phone while driving. Accumulating points on your license can ultimately result in license suspension or revocation under the state's persistent violator rules.

You may wonder if getting points on your license will affect your insurance premiums—It could! Insurance carriers may use these points as underwriting criteria. However, this is determined by each carrier in conjunction with other variables. Some insurance carriers may already be using cell phone violations (not points) as underwriting criteria so the rule change may not necessarily have a direct effect on premiums at all.

More importantly, driver distraction is a factor in more than 20 percent of all car crashes in New York State. In 2009, nearly 5,500 people died nationwide in accidents involving a distracted or inattentive driver. For your own safety and that of others on the road we urge you not to use a hand-held device while driving.

But if you do receive a cell phone violation call your agent or our office immediately. We can help you find out how it will affect your premium.

"MOVE OVER" LAW TOOK EFFECT JAN. 1

Beginning Jan. 1, 2011, drivers in New York have to move over and slow down when they see emergency vehicles with flashing lights on the road. The Ambrose-Searles Move Over Act is designed to keep emergency workers safe on highways and roads statewide.

Under this law, motorists are now required to move over and slow down to avoid colliding with an emergency vehicle which is parked, stopped or standing on the shoulder of the road with its emergency lights on. Anyone who violates this law could be fined up to $275 and have two points added to his or her driver's license.

The new law is named after Trooper Robert W. Ambrose and Onondaga County Sheriff Deputy Glenn M. Searles, both were killed in the line of duty while their patrol cars were stopped on the side of the road.

Your Professional Insurance Agent…

We want you to know about the insurance you’re buying.

Alan Plafker is President of Member Brokerage Service LLC, a Melrose Credit Union Service Organization. He is a licensed Insurance Broker and serves as Treasurer on the Board of Directors the PIANY (Professional Insurance Agents Association of NY), serves on the Board of CIBGNY (Council of Insurance Brokers of Greater NY), and was appointed to the New York Independent Livery Driver Benefit Fund Board of Directors. His Agency insures thousands of polices for TLC Insurance as well as many policies for all types of insurance. You can reach him in his Briarwood, Queens office at (718) 523-1300 ext. 1082, or visit the website at: www.MemberBrokerage.com.