|

|

BET THE HOUSE: WHY THE FHA IS GOING (FOR) BROKEPeter J. Wallison, Edward J. Pinto • American Enterprise Institute

No serious observer of the Federal Housing Administration (FHA) believes its financial future is bright. But few recognize just how troubled this government agency really is. That is because it uses lax accounting standards that obscure real and present danger to its own bottom line and the American taxpayer. In fact, when measured against the accounting system used by private mortgage insurers, the FHA is deeply insolvent with a capital shortfall of tens of billions of dollars. If it were a private firm state regulators would immediately shut it down. Even using its own rosy numbers puts the FHA’s leverage at 840 to 1, a far more scandalous ratio than even Fannie Mae and Freddie Mac. As shown by Fannie and Freddie as recently as 2008 and the slow motion collapse of the savings and loans (S&Ls) in the 1980s, if government backed entities are allowed to continue operating when they are insolvent, their losses will only compound. Indeed, the FHA has almost tripled its insurance in force in only three years, in part to cover its losses. And Congress made matters worse last fall when it raised the FHA’s conforming loan limit to $729,750. That pleased the powerful National Association of Realtors, but it simply poured fuel on the fire. Before the agency’s losses skyrocket triggering a massive taxpayer bailout that deepens our nation’s debt, Congress should reverse that mistake and enact reforms to pull the FHA back from the brink. Key points in this Outlook:

Just before Thanksgiving 2011, the US Congress sent a turkey to the taxpayers by raising the conforming loan limit—the maximum size of mortgages that the FHA is permitted to insure. The Dodd Frank Act had reduced the limit from $729,750 to $625,750, effective October 1, 2011, and signs indicated that private sector lenders were entering this new area of permitted activity. But in November, Congress, under pressure from the National Association of Realtors, the powerful lobbying group for residential real estate agents, reversed its earlier decision and returned the limit to $729,750. The FHA appears to be on its way to insolvency, and the members of Congress who supported the increased limit, led in the Senate by Robert Menendez (D-N.J.) and in the House by Barney Frank (D-Mass.), William Posey (R-Fla.), Gary Ackerman (D-N.Y.), and John Campbell (R-Calif.), will have a bone to pick with the Realtors when the facts get out. Unless Congress takes action soon to stop FHA’s practices, its losses will continue to build. Government backed enterprises like the FHA, the S&Ls, and Fannie and Freddie can continue operating even as they are failing because their creditors have no reason to shut them down. Characteristically, they increase their risks and their future losses in the hope of a magical recovery. If the FHA were a private mortgage insurer it would have been closed down well before this. The question now is whether Congress and the administration will let the agency’s losses build up until a massive rescue becomes unavoidable. The FHA’s accounting, as we describe in this Outlook, allows it to hide its losses in an ever growing insurance portfolio. Eventually, of course, in every bailout situation the accounting all comes apart and enormous losses are exposed. When this occurs, the taxpayers are incensed, but often do not know whom to blame. In this case, when the taxpayers realize that by increasing the FHA’s conforming loan limit a majority in Congress added to the US debt and set up yet another government housing agency for a costly bailout, they will know who is responsible.

As complicated and unusual as it is, the FHA’s accounting system can still be penetrated and understood. It shows that the agency’s traditional single family program has about $1.2 billion in “economic value”, which, under government accounting, is called “capital” supporting over $1 trillion on loan guarantees. That is leverage of close to one thousand to one, far outstripping even the government sponsored enterprises’ (GSEs’) scandalous record. As we will show, using its own optimistic assumptions, the FHA is already on the verge of insolvency. If its accounting were closer to the customary accounting for a mortgage insurance company it would be deeply insolvent, and no state insurance regulator would allow it to continue operating. "If it were a private mortgage insurer, the FHA's fund would have been taken over by its regulator long ago." The FHA insures 100 percent of the principal and interest on residential mortgages and seeks to recoup its losses with a 1 percent upfront premium and slightly higher annual premiums on outstanding loans. However, the agency’s accounting does not follow the usual pattern of mortgage insurance accounting in which two separate reserve funds must be set aside. The first holds current capital sufficient to cover expected losses from known delinquent loans, and the second holds half of premiums earned to cover periods of high losses. At the same time, a private mortgage insurance firm must maintain a minimum capital level of 4 percent. All of these requirements must be met from current assets. In contrast, the FHA’s insurance fund is required to maintain an “economic value” also called a capital ratio of at least 2 percent of its insurance in force. Although this requirement is intended to provide a cushion against unexpected losses, the FHA’s capital ratio is nearly zero today and has been in violation of the 2 percent rule for more than three years. Under the accounting system approved by Congress for the FHA, the agency’s capital is the amount left over when the present value of its future insurance obligations is subtracted from its current net assets and a projection of future income over the next thirty years. This means that the FHA can include in its capital the net earnings it anticipates thirty years into the future. This practice bears a remarkable resemblance to Enron’s infamous use of assumptions about the future to bring fictitious future profits into the current year’s earnings. In other words, the FHA can be insolvent today, unable to cover even its expected losses on current delinquent loans, yet still show a positive capital account. Further, because it is relatively easy for the FHA to adopt assumptions or projections that keep its economic value in positive territory, this system also calls into question the usefulness of economic value or capital ratio as a measure of the insurance fund’s financial health. For example, the FHA can reduce its expected losses simply by making an optimistic projection for the future growth of housing prices. If prices rise in the future, losses will be lower; if they rise slowly or fall, losses will be greater. The FHA appears to be following this strategy. Despite the current conditions in the housing market with a large overhang of unsold homes, falling prices, and millions of mortgages in default and not yet foreclosed, the FHA has estimated that housing prices will rise by an average of 4 percent per year over the next nine years. To put this in perspective, a December 2011 survey of 109 housing experts projected an average 2 percent annual increase over the years 2012–16, about half the FHA’s estimate for the same period. Significant home price inflation, by reducing expected losses, gives the FHA the appearance of solvency when, as we will explain, it is currently insolvent by any reasonable accounting standard. Moreover, relatively little accountability exists in the FHA’s accounting system; if its projections turn out to be overly optimistic, the FHA can always blame “unanticipated” market conditions. Optimistic home price projections are particularly important to the FHA because its core business is insuring thirty-year fixed rate loans. An FHA thirty-year loan is especially risky to insure because it often combines a minimal down payment with slow amortization, resulting in minimal home buyer paid-in equity over the early years of the mortgage. Projecting healthy home price growth also allows the FHA to mitigate this problem by assuming lower future levels of insurance losses.

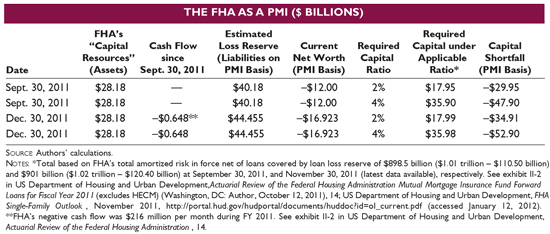

Using these and other optimistic assumptions and projections the FHA’s insurance fund for its core single family program had an economic value, or capital ratio, of 0.12 percent of its insurance in force as of September 30, 2011, the end of its fiscal year. This was well below the 2 percent statutory required level and just barely “solvent” according to its peculiar accounting system. Further, it is nowhere near the 4 percent capital and reserve requirements applicable to private sector mortgage insurers. When compared with private sector insurance accounting required by state insurance regulators the FHA’s insurance fund is clearly insolvent today. The fund’s balance sheet at the end of fiscal 2011 shows capital resources of $28.18 billion. At that time, the FHA estimated the net present value of its future premium receipts (net of expected losses) at a net loss of $26.99 billion giving the fund an economic value of $1.19 billion. This yields the 0.12 percent capital ratio (its economic value as a percent of insurance in force) cited above at the end of fiscal year (FY) 2011. To put this in perspective, as recently as 2006, the FHA’s capital ratio was 7.38 percent. If this were a real capital ratio a decline of this size would be bad enough, but the “capital” in the FHA’s capital ratio is not even made up entirely of tangible assets; as noted above, it is primarily expected future insurance losses subtracted from current net assets and expected future insurance premiums over the next thirty years. The FHA’s estimate of its future premium receipts, net of anticipated losses, is the key metric in calculating its economic value and capital ratio. However, private mortgage insurers would never be allowed to measure their solvency on such an uncertain standard. Instead, their current expected insurance losses are measured against known facts—their current capital resources. "The activities of the GSEs, the FHA, and the VA are adding to the government's debt." To estimate the FHA’s capital adequacy on this basis,not with future projections over the next thirty years, one must begin with expected losses on the FHA’s known delinquent loans. As of December 30, 2011, 12.1 percent of the FHA’s insured loans (889,602 loans) were sixty days or more past due. This number is up substantially from both the 10.55 percent (749,204 loans) that were delinquent as of June 30, 2011, and the 11.1 percent (803,899 loans) that were delinquent as of September 30, 2011—only three months earlier. Under the reserving practices of private mortgage insurers, both claim rates and loss percentages on delinquent loans would be calculated based on recent experience. In preparing table 1, we analyzed the reserving practices of a private mortgage insurer (PMI), Genworth Mortgage Insurance Company, and found that Genworth had reserved $28,800 for each loan sixty days or more past due and had an average net paid claim of $46,900. Thus, Genworth’s loss reserve per delinquent loan as a percentage of the average claim paid was 61.4 percent. Said another way, Genworth assumed that 61.4 percent of its known sixty-days plus delinquent loans would ultimately result in a paid claim. As of the end of December 2011, the FHA had 889,602 delinquent sixty days plus loans, along with an average gross paid claim of $128,574 and a net paid claim of $81,387. FHA does not make available sufficient data to determine on the basis of these numbers what its reserves should be. However, based on Genworth’s practice, we can estimate that an insurance book with FHA’s paid claims experience and more than 889,000 loans that are sixty or more days past due should have a loss reserve of about $44.45 billion. The table below shows what a PMI such as Genworth would look like if it had the FHA’s delinquent loans, risk exposure, capital resources, and capital ratio under both the 2 percent statutory requirement for the FHA and the 4 percent of risk-in-force requirement applicable to private mortgage insurers.

Amazingly, it is in this context that Congress decided to increase the conforming loan limits for FHA insurance measurably adding risk and potential losses to an already effectively insolvent government agency. Indeed, the increase in risk is considerably greater than it first appears. When the conforming loan limits for the FHA and the GSEs were originally set at $729,750 in the Housing and Economic Recovery Act of 2008 (HERA), the country was just coming off a housing bubble. Housing prices were 25–35 percent higher than they are now. The same $729,750, accordingly, now covers a much larger share of the market than was originally intended by HERA. In other words, Congress not only chose to pile more risk on an insolvent federally backed mortgage insurer, but also increased the percentage of the housing market that the FHA’s insurance would cover. Eventually, when its Enron style accounting can no longer hide its losses, even under the most optimistic accounting and showing that the agency’s capital ratio is in positive territory only by the barest sliver, the FHA will become another major bailout for the taxpayers. Presumably, when these facts are finally disclosed, the taxpayers will have some pointed questions for those in the Senate and House who brought this about. It is important also to consider what the FHA’s projected losses mean to home buyers. As we noted, 11.8 percent of the agency’s loans, or about one in eight, were sixty-days-plus delinquent at the end of November 2011. This implies more than simply that the FHA was then insolvent. It also means that a very large percentage of families with FHA loans are at risk of eventually losing their homes. The FHA will likely respond by saying it tightened up its underwriting standards after 2008. Yet the FHA’s own actuarial study projects that, even with its rosy scenarios, its “good books of business” from 2009 to 2011 will experience an average cumulative claim rate of 8.5 per 100 loans. The worst 30 percent of the loans from the 2009–2011 books would therefore be expected to have a claim rate of about 15 per 100 loans. Under less optimistic assumptions this rate could increase substantially. With many of these loans geographically concentrated the “FHA effect” on neighborhoods will likely be sizeable. That is the other side of the coin when a government agency lowers its underwriting standards so that more individuals or families can buy homes. The taxpayers are not the only ones who take a hit. In the Dodd Frank Act, Congress imposed harsh penalties for the origination or purchase of a loan that was not a qualified mortgage (QM), that is, a mortgage that the borrower did not have a reasonable ability to repay. In other words, Congress was suggesting that extending loans that result in a high foreclosure rate reflected inadequate or insufficient underwriting. The FHA’s expected failure rate is a direct challenge to the standards established by Dodd Frank and raises the question of whether the FHA will be able to function at all in the future unless, as Dodd Frank permits, it exempts itself from the QM requirements. If it does so, the FHA will be able to continue its expansion which is necessary to obscure its losses, but at some very high human costs.

In adopting legislation to increase the FHA’s conforming loan limit, Congress was following a familiar path manipulating an insurance program to placate a powerful interest group. It is laughable to suggest that a $729,750 mortgage is a loan to one of the low income buyers that the FHA was mandated to help. In FY 2011, 54 percent of the FHA’s dollar volume went to finance homes that were greater than 125 percent of an area’s median home price, up from 36 percent in 2010. In the same year, 38 percent of FHA insurance covered homes with prices greater than 150 percent of the area median, up from 22 percent in 2010. The FHA, accordingly, is shunning its former role as the government’s insurer for low income home buyers and becoming a subsidizer of middle and upper middle income homes —and losing money at that. Authorizing loans of this size was a political gift to the Realtors who wanted this change to help them sell more homes. Fannie and Freddie had previously been the largest buyer of the mortgages the Realtors needed, but since their insolvency and take over by a government conservator, the two GSEs have tightened their underwriting standards and acquired fewer default prone loans. This meant that they would require higher down payments and credit scores and lower debt-to-income ratios, a policy that reduced the ability of the Realtors to sell homes with GSE financing, especially those in the upper brackets of the market. This caused the “action” in home sales, as between the GSEs and FHA, to move to the FHA which ramped up its market share vis-a vis the GSEs from approximately 6 percent in 2007 to approximately 30 percent in 2011. "We are watching-in not-so-slow motion--the same gradual descent into insolvency that occurred with Fannie and Freddie a little more than three years ago." As a result, the FHA’s insured loans outstanding have risen from $350 billion in 2007 to over $1 trillion today. Although the credit characteristics of these additional loans have improved somewhat compared to three or four years ago, it is worth noting that three-quarters of the FHA’s home purchase loans in 2010 are still high risk having one or both of these characteristics:

The FHA also has incentives to increase its market share and its insurance in force. Through the accounting methods we described, the FHA can hide its likely insolvency by growing its insurance in force. This increases the present value of its future premium gains and, coupled with optimistic estimates about its future losses,can give the illusion of continued solvency. In 2011, the FHA had a 77 percent market share compared to 23 percent for private mortgage insurers. While this was happening, the FHA’s capital ratio declined to near zero, and under traditional insurance accounting it would be insolvent. In other words, we are watching, in not-so-slow-motion, the same gradual descent into insolvency that occurred with Fannie and Freddie a little more than three years ago. Since late 2007, the private mortgage insurance industry has raised $10.1 billion in new capital and could likely have raised more had it not been crowded out by the FHA. If increasing its insurance in force is indeed the FHA’s strategy, it is typical of agencies and firms that have access to government support. They are able to continue to borrow on the government’s credit when private companies would already have been closed down by their creditors so they keep operating until their losses can no longer be hidden. The insolvency of the GSEs is one example of this. They were able to borrow and keep the game going until their shareholders, recognizing the reality of their losses, bailed out in August 2008 signaling the necessity of a government takeover. The S&L debacle in the late 1980s is another example of this phenomenon. Instead of cutting back on their risks as they began to incur losses, the S&Ls doubled down in the hope of growing out of their financial difficulties. To avoid risk taking of this kind, the Federal Deposit Insurance Corporation (FDIC) Improvement Act of 1991 gave bank regulators the authority to close down failing banks and S&Ls before they actually became insolvent. Unfortunately, the FDIC has not been able to successfully accomplish even this task suffering losses averaging 25 percent on the banks it has closed in the last three years. But in passing this act, Congress at least recognized the pattern of behavior that enabled the GSEs and insured S&Ls and banks to dig bigger financial holes as they began to suffer losses. The same pattern is now occurring with the FHA. Growth in the FHA’s insurance coverage is also a worrisome trend in itself. Government insurance agencies of every kind are notoriously poor at setting their premiums at rates that will compensate them for the risks they are taking on. The FDIC, the Pension Benefit Guaranty Corporation, and the National Flood Insurance Program are all examples of government insurance programs that are ultimately loss makers for the taxpayers. One of the reasons for this is probably that the managers of these enterprises do not have the same incentives as private insurance managers to protect their firms against risks. Another reason may be that Congress pressures the managers of government insurance programs to go easy on the ratepayers who have a strong incentive to complain to Congress about high rates. As in the case of the Realtors’ pressure on Congress, the taxpayers may never find out that Congress favored an interest group instead of the taxpayers. In the end, the game will have to stop; it will become impossible to hide the losses, and Congress will have to step in recapitalize the FHA’s insurance fund so it can continue to meet its insurance obligations. At that point, it will be healthy for our political system if the taxpayers get a chance to read this Outlook.

But the impending losses to the taxpayers and the reduction in the FHA’s focus on low income mortgages are not the only reason to see Congress’s increase in FHA’s conforming loan limit as a policy disaster for the country. In today’s housing finance market, more than 90 percent of all mortgages are acquired and securitized with a GSE guarantee or insured by the FHA or the Department of Veterans Affairs (VA) and securitized by Ginnie Mae with a government guarantee. This situation is not sustainable. The activities of the GSEs, the FHA, and the VA are adding to the government’s debt which, at almost $14 trillion, is already at dangerously high levels. As our colleague Alex Pollock has noted, the off budget debt of various government agencies, the majority of which is GSE debt, is $7.5 trillion, all of which is ultimately the responsibility of the federal government. This brings the total US debt to more than $21 trillion. The fact is that the government must leave the housing finance market; even the Obama administration has taken this position arguing in a February 11, 2011 white paper that the government’s role must be replaced with private capital through either establishing a fully private securitization market or requiring private capital to take the principal mortgage risks with the government functioning only as a backstop. The US banking system, including the S&Ls, is not large enough to finance the $11 trillion housing market so, ultimately, the United States must rely on a private securitization system to provide the supplemental financing that will enable Americans to buy homes. However, since the financial crisis of 2008, this system has been moribund. Part of the reason is that the Dodd Frank Act has added a number of regulations and restrictions to the financial markets and the housing finance market in particular, that make the revival of a private market difficult or impossible. Among these is a 5 percent risk retention requirement for most securitized mortgages. Because this requirement would not apply to FHA insured mortgages it would make these mortgages less expensive than privately securitized mortgages. This would be another spur to the use of the FHA and another reason the Realtors wanted an increase in the FHA’s conforming loan limit. In addition, the draft implementing regulations for this section of the Dodd Frank Act would not apply the 5 percent risk retention requirement to the GSEs so they too will have inherently lower costs than privately securitized mortgages. A private securitizer can avoid the 5 percent retention requirement by securitizing a high quality mortgage, one, for example, with a 20 percent down payment but these will be rare. Because of this and many other Dodd Frank created advantages for the government backed housing market financing, most market participants will be focused on originating mortgages that will be bought by the GSEs or insured by the FHA. And since the FHA will have the lowest standards and the broadest scope it is likely to become the go-to player in the housing finance market over time. This will not only inevitably increase future foreclosure levels (recall the risky nature of the FHA’s 2010 book of business described earlier in this Outlook), taxpayer losses, and the size of the US debt, but it is also precisely the wrong direction for the future development of a private securitization market. Quite apart from the impediments to private securitization created by the Dodd Frank Act, a private market will not revive in the United States as long as the GSEs and the FHA exist in their current form and with their current market scope. No private firm can compete with the government in housing finance as long as the government’s risks are subsidized by the taxpayers. Mortgages are risky assets. They are only as good as the credit of individual borrowers; although the house is collateral support for the loan, if the mortgage has to be foreclosed the lender almost always suffers a loss. A private securitization system recognizes these risks through the rate charged for the mortgage. In general, as in every other part of our economy where collateralized loans are made—auto loans, for example—the private securitization system produces an interest rate that accounts for the sum of the many risks involved in a loan, as well as a profit that is the inducement for taking those risks. Before the financial crisis, the rate in the private securitization of “jumbo” mortgages, mortgages larger than the conforming loan limit, was generally twenty-five to forty basis points higher than the Fannie or Freddie rate. This differential reflected the real risks on the mortgages. The GSEs’ rate was lower because a portion of the GSEs’ risk was ultimately taken by the taxpayers. The proof of this rests in the fact that the taxpayers have already incurred a loss of at least $150 billion for the privilege of backing of Fannie and Freddie. The private market is willing to take mortgage risk and can effectively price it, as it does with car loans and other securitized assets. This is shown by the increase in private sector mortgages in the months before the conforming loan limit was raised. With a statutory provision that reduced the conforming loan limit to $625,750, space appeared to be opening up for the private sector to be compensated for taking mortgage risk. That activity closed down when the FHA conforming loan limit was increased in November; at that point, it became clear that private sector lenders, like banks and S&Ls, would have to compete with the taxpayer subsidized GSEs and the FHA.The private market cannot be expected to put in the investment necessary to finance mortgages until it is clear that the GSEs will be wound down or privatized and the FHA will be confined to insuring low income loans. The fact that a majority in Congress voted to support the interests of the Realtors is a bad sign both for the future of housing finance and for the taxpayers. In its best light, it may mean that Congress did not know that the FHA was insolvent when it loaded the agency down with more responsibilities. In its worst light, it suggests that many members of Congress still do not consider either the seriousness of the nation’s debt or the interests of the taxpayers when they are pressed to provide benefits to a powerful interest group. In the end, the FHA’s current condition should be a wake-up call for Congress. It made a huge mistake in increasing the FHA’s conforming loan limit. This should be fixed as soon as possible. But that will not be enough. Today the FHA has more incentive to increase its risk taking than to reduce it as was true of the government insured S&Ls and countless insured banks in the past. Before the agency’s losses skyrocket, Congress should bite the bullet, recognize the losses that are already embedded in the FHA’s insurance fund and adopt reforms to the agency’s accounting and underwriting that will stop the bleeding.

Peter J. Wallison (pwallison@aei.org) is the Arthur F. Burns Fellow in Financial Policy Studies at AEI, and Edward J. Pinto (edward.pinto@aei.org) is a resident fellow at AEI. © 2013 TLC Magazine Online, Inc. |