Feb 7, 2017

Richie Bernardo, Senior Writer

The border between the U.S. and Mexico may soon expand into a 40 foot high, 1,000 mile long concrete barrier separating us from them. On Jan. 25, President Donald Trump issued an executive order to immediately begin erecting a border wall. But the million dollar question or, more accurately, the $15 to $25 billion question is: Who will pay for it?

During his presidential campaign, Trump suggested that Mexico itself should fork over the cash to keep its own citizens out of American soil. And when our southern neighbor refused, Trump instead proposed taxing all Mexican imports by 20 percent to finance the wallís construction. In brief, the so-called ďborder-adjusted taxĒ would be imposed on U.S. corporations and discourage them from off shoring business.

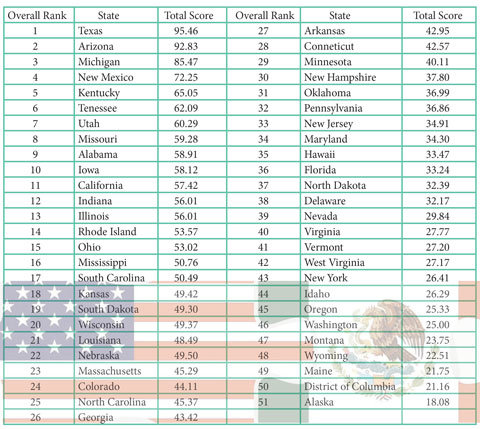

If and when the presidentís plan comes to fruition, experts predict it will trigger a trade war between our two nations. But the impact of the economic fallout will be different for every state. WalletHubís data analysts therefore compared the 50 states and the District of Columbia across five key indicators gauging the effects of the possible trade battle. Read on for our findings, expert insight on the issue and a full description of our methodology.

According to official estimates, Mexico is the third largest trading partner of the U.S., with exports and imports combined totaling $583.6 billion in 2015 as well as sustaining about 1.1 million jobs in the previous year. President Trump, however, intends to overhaul the North American Free Trade Agreement, or NAFTA, a move that many of his critics fear will result in significant economic and political repercussions on both sides of the U.S.-Mexico border.

A great way for married couples to split living expenses is to divvy them up by percentage. For example, if you make 70 percent of the household income, you should pay 70 percent of the bills. This helps avert an unfair burden if you were to just split the costs 50/50 which doesn't make sense if your partner's income is much lower than yours.

1. Who in the U.S. will be most affected by a trade war with Mexico?

2. What would be the economic impact to the U.S. of pulling out of NAFTA?.

3. What is the likelihood that a trade war with Mexico puts either country into a recession?

4. What is the best way to encourage companies to keep production facilities in the U.S., other than a tax on imports?

Harlan Holt, Visiting Assistant Professor of Economics at Union College

Who in the US will be most affected by a trade war with Mexico?

Trade barriers protect local industries by shielding them from helpful foreign competition. This may mean that older, inefficient firms will be allowed to continue to produce and the primary effect will be higher prices on consumers.

Our largest imports from Mexico are automobiles and machinery. Even ďAmericanĒ car brands such as Dodge and GM have at least some of their production based in Mexico. So you can expect the consumers in these markets to be harmed the worst in a trade war. Of course, as with any policy that causes prices to rise, itís the poor who will suffer the greatest burden.

In addition, Mexico is also the second largest market for US exports in the world. So you can expect US exporters and their employees to feel the pain as well.

What would be the economic impact to the US of pulling out of NAFTA?

NAFTA has led to increases in the trade sectors of all three North American partners. Because the US is such a huge and well diversified economy, however, its impact on US GDP by most estimates has been rather small but still positive.

So the direct economic impact on the US is likely negative, higher prices, lower GDP, but only modestly so. Itís important to note that trade with Mexico wonít completely go away if we pulled out of NAFTA. It would just be more difficult and more costly. Mexico would likely be harmed more than the US given that trade with the US is a more important part of its economy.

What is the likelihood that a trade war with Mexico puts either country into a recession?

Very unlikely. A trade war would be harmful for us, especially for consumers and the poor, but hardly the kind of cataclysmic event that would cause a significant recession. While the effects would be more harmful for Mexico which depends on the US to place its exports, itís still pretty unlikely that this would cause any kind of extreme event like a recession.

What is the best way to encourage companies to keep production facilities in the U.S., other than a tax on imports?

Itís very frustrating that the obvious and best solutions are scorned by the left and ignored by the right. If we want companies and jobs to stay in America, we should give them incentives to do so:

Finally, poor labor policy has been making US labor more expensive to hire since the Great Depression. If we want our workers and production to be competitive against low priced foreign labor, then stop making US labor more expensive.

Higher minimum wage laws should be resisted, union shop laws should be repealed with right-to-work legislation, and payroll taxes should be eliminated. All of these things are reasons why we lose production to other countries.